우리 코스 탐색

자산 관리 및 통제

14 시간자산 관리 및 준수

14 시간문제 해결을 위한 루트 원인 분석(RCA)

14 시간통합 위험 관리 및 기업 지배 구조

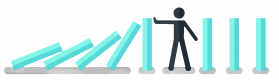

35 시간프로젝트 리스크 관리

7 시간위험 식별 및 관리 기초

7 시간최근 업데이트:

회원 평가(2)

워크샵, 오픈 토론

Renata Ostrowska - BFF Polska S.A.

코스 - Planning and Risk Assessment

기계 번역됨

하칸은 매우 열정적이고 지식이 풍부했습니다

Hugo Perez - DENS Solutions

코스 - Project Risk Management

기계 번역됨

예정된 코스

다른 국가들

이 코스들은 다른 국가에서도 제공됩니다

주말Risk Management코스, 밤의Risk Management트레이닝, Risk Management부트 캠프, Risk Management 강사가 가르치는, 주말Risk Management교육, 밤의Risk Management과정, Risk Management코칭, Risk Management강사, Risk Management트레이너, Risk Management교육 과정, Risk Management클래스, Risk Management현장, Risk Management개인 강좌, Risk Management1 대 1 교육